Recapitalization: Nigeria's Financial Revolution in Full Swing!

A Deep Dive into Nigeria's Banking Recapitalization

What’s popping guys,

Hey there, it's mid-week already, and I have something exciting for us, just as promised! But before we dive into serious business, let's start with a quick check-in: How is everything going? How are you feeling today?

I hope the answers are all positive, but if not, remember to keep grinding and stay optimistic because things will fall into place eventually. The stars are always aligning for us!

So today, I will be talking about the recapitalization of Nigerian banks.

On March 28, 2024, the Central Bank of Nigeria under the leadership of Headmaster Yemi Cardoso announced a policy towards recapitalizing Nigerian Banks. The last time we saw this was in 2004 when Soludo ordered the recapitalization of banks from a base of ₦2 billion to ₦25 billion. Back then, the number of money deposit banks decreased from 89 to 25 due to mergers and acquisitions, with some also downgrading their operational licenses.

So before the technicals, just a little explanation.

Let us first dissect the phrase “recapitalization of banks”. The foundation word here would be capital which is the money that a bank has obtained from its shareholders and other investors and any profit that it has made and not paid out. For banks, there is usually a capital threshold set by the central banks in each country which banks are expected to be above no matter the situation. Therefore, recapitalization is an increase in this minimum capital threshold. The central bank will order a recapitalization for several reasons, but the major goal is usually to strengthen the banks.

So back to Nigeria Banks Recapitalization.

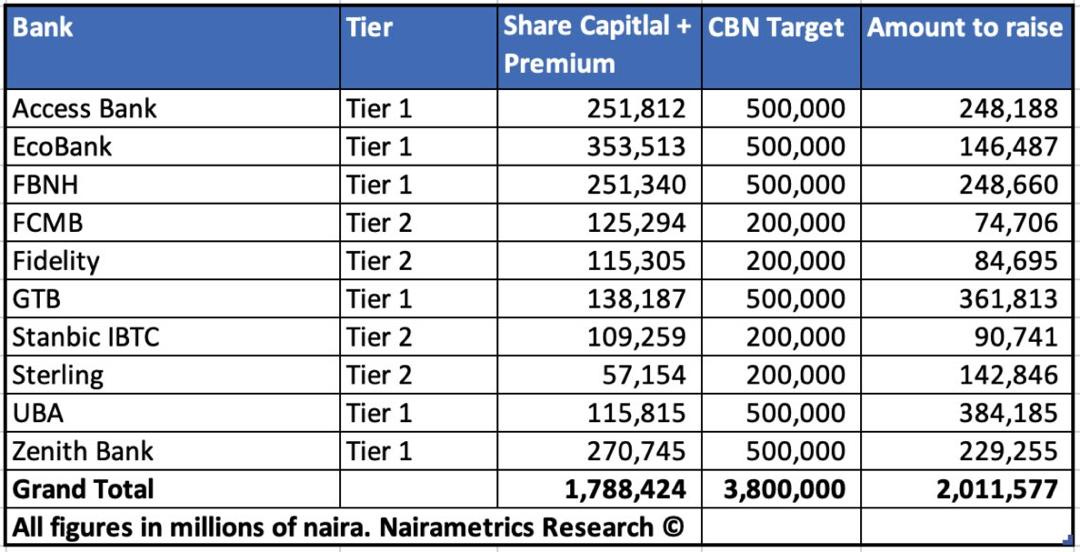

The recapitalization plan for Nigerian banks involves raising the capital requirements for commercial banks with international authorization to N500 billion, national banks to N200 billion, and regional banks to N50 billion. Non-interest banks with national and regional authorizations are also required to increase their capital to N20 billion and N10 billion, respectively. This translates to a significant increase in the capital balance required for banks operating in Nigeria.

The Central Bank of Nigeria (CBN) laid out specific guidelines for how banks should raise this capital. Notably, Nigerian banks are known to have a war chest of retained earnings, which the CBN exempted from this policy. The apex bank's focus is on encouraging banks to seek new funds rather than relying solely on their existing reserves.

Banks are expected to choose one or a combination of methods to meet the new requirements:

Issuance of new common shares (by way of public offer, rights issues, or private placements);

Mergers and Acquisitions (M&As); or

Upgrade/downgrade of their respective license category or authorization

Banks were granted until March 31st, 2026, to meet the required capital targets. The amount of capital each bank needs to raise varies across different tiers and segments of the banking sector.

image showing the capital banks would need to raise

So what does this mean for our Economy?

According to the National Bureau of Statistics (NBS), Nigeria's GDP in 2023 stood at approximately ₦234 trillion ($180 billion). One of the current administration's objectives is to boost the nation's economy to $1 trillion by 2026 and $3 trillion by 2030. Achieving these targets necessitates a robust financial system that enables banks to undertake larger risks, remain resilient during challenges, and provide vital support across various sectors and tiers of the economy.

One significant outcome of this policy is the increased inflow of foreign exchange (FX) into the economy, aimed at bolstering the stability of the naira. This influx of FX results from banks' efforts to attract foreign portfolios and direct investments for capital expansion. Moreover, the policy is expected to stimulate business activities due to enhanced liquidity within the banking system, thereby improving access to funds for all economic stakeholders (individuals, corporations, and government) while simultaneously lowering interest rates for borrowers. Particularly, small and medium-sized enterprises (SMEs) stand to benefit significantly as they have traditionally received limited support from commercial banks.

Another objective is to fund economic activities, stimulate production, and address the supply challenges in the Nigerian economy. This will lower prices, thus enhancing purchasing power. These combined efforts are expected to significantly boost the country's GDP.

What are banks doing to achieve this target?

The banking sector in Nigeria is poised for significant capital injections, with an estimated total fundraising target of approximately ₦4.7 trillion. Among the major players, 12 leading banks listed on the Nigeria Exchange Limited are looking to bridge a funding gap of N2.8 trillion, while other banks outside the Exchange are targeting an additional N1.9 trillion.

Access Holdings Plc, the parent company of Nigeria's largest bank by assets, is planning to raise approximately ₦365 billion through a right issue to bolster its capital base. Similarly, Guaranty Trust Holding Company (GTCO) Plc intends to undertake a public offer, aiming to raise between ₦450 billion and ₦525 billion to fortify the capital structure of its banking subsidiary. In tandem with these initiatives, First Bank Holdings is set to raise an additional ₦300 billion to further strengthen its capital base.

Summary

The CBN is putting efforts to make banks face the main essence of their existence which is to fund the growth of the economy. This policy is poised to bring about multiple advantages for the Nigerian economy, generating positive multiplier effects and contributing to key economic objectives such as GDP growth, controlled inflation, and reduced interest rates, thereby fostering financial stability.

So let us sit back and watch the action!

See you on Sunday!!

Your feedback means the world to us, so don't hesitate to share your thoughts and suggestions through this anonymous link. ✨https://forms.gle/a3YNErzSeALgU6TR9. You can also leave a comment in the comment section below.

Catch you in the next edition! 🚀📰

Editor in Chief: Abraham Onadokun